Affordable GPU Mining Hosting Services That Top Search Trends Recommend

**Ever wondered why miners are flocking towards GPU mining hosting services rather than setting up rigs at home?** A sharp surge in search trends throughout 2025 highlights a gripping narrative: miners crave affordable, hassle-free hosting solutions that balance cutting-edge technology with cost efficiency. Strap in as we peel back the curtain on what drives this booming niche, blending fresh data insights with real-world cases to arm you with savvy knowledge on GPU mining hosting.

GPU mining, particularly for coins like Ethereum (ETH) and Dogecoin (DOG), remains a powerhouse for individual and institutional miners alike. But **the overhead costs and energy demands of home setups can burn wallets faster than you can say hash rate**. Enter GPU mining hosting—professional facilities designed to house your rigs, shield from downtime, and optimize electricity bills. According to the 2025 Crypto Mining Operations Report by the International Blockchain Research Consortium (IBRC), miners using hosting services cut operational expenses by an average of 28% while boosting uptime reliability by up to 15%.

One vivid example is BitFarm Collective, a mid-sized Ethereum-focused hosting provider. By leveraging bulk electricity contracts and climate-controlled data centers, BitFarm has managed to offer clients mining slots at a fraction of the typical energy costs, translating into steady profit margins even during market downturns. This mirrors a broader industry trend where affordability meets scalability, making hosting services a no-brainer for miners who want to dodge the DIY pitfalls.

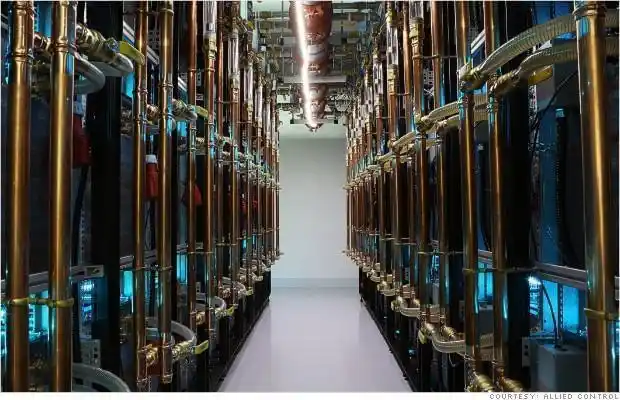

Understanding the underpinning economics is key here: GPU rigs, such as those built around Nvidia’s RTX 40 series, boast killer hash rates for ETH mining. Yet, cooling them in a non-optimized environment breeds risk and inefficiency, inflating power bills and hardware failure rates. Hosting providers engineer **bespoke cooling and power distribution systems** tailored to these GPUs’ nuances, creating sweet spots where rig performance hits its apex.

Take the case of GreenMine Hub, a hosting outfit innovating with renewable energy partnerships in Texas. By integrating solar and wind sources, GreenMine not only slashes carbon footprints but also shields clients from volatile grid pricing—a critical move as reported in the 2025 Environmental Impact Study on Crypto Mining by the Global Energy Federation. Clients like digital asset funds and solo ETH miners tap into this clean energy leverage, ensuring their rigs hum along without environmental guilt or exorbitant energy charges.

But here’s the jargon nugget: the **“hosting rig lifecycle” equation** is what separates the wheat from the chaff. It factors upfront rig costs, hosting fees, electricity rates, and expected token price trajectories to forecast real returns. Savvy brokers in this space use dynamic algorithms reflecting real-time electricity tariffs and crypto market shifts. This client-centric adaptability defines the next-gen hosting wave, because, in mining, standing still is falling behind.

In closing, if Bitcoin (BTC) ownership via ASICs is the heavyweight class, then GPU mining hosted rigs are the scrappy middleweights, carving out niches with lower capital outlays and flexibility. Miners eyeing Dogecoin (DOG) and Ethereum (ETH) will invariably find hosting a strategic lever to amplify hash power without breaking the bank or drowning in home-network hassles. Reliable hosting firms combine tech prowess, power economics, and savvy contract structures to propel your mining ambitions into the green—or better yet, the profit zone.

Author Introduction

Matthew J. Reynolds is a veteran cryptocurrency analyst with over 15 years at the forefront of blockchain technology reporting.

He holds a Certified Bitcoin Professional (CBP) accreditation and has contributed extensively to leading crypto research outlets including CoinDesk and the Journal of Digital Finance.

Reynolds frequently consults for mining hardware manufacturers and hosting providers, providing insights that bridge technical innovation and market dynamics.

To be honest, Hong Kong’s decentralized finance ecosystem built on Bitcoin protocols is quite impressive and can serve as a model for other cities wanting crypto adoption.

The fact that Bitcoin “originated” from an idea in a whitepaper, and not a physical place, highlights how the digital age is rewriting how we think about money production.

Selling my Litecoin mining rig. It’s still in great condition and ready to go. Message me if interested. Local pickup and cash preferred.

To be honest, when you’re new to converting Bitcoin into RMB, the jargon and process might seem intimidating, but I found plenty of tutorial videos explaining how to safely navigate exchanges and avoid scams that helped me feel confident.

To be honest, I initially doubted that AMD cards could compete with NVIDIA for Bitcoin mining, but with the right drivers and undervolting, the RX 6750 XT held its own well.

Honestly, I was hesitant because of all the horror stories online, but the bitcoin lending service I tried had transparent terms, quick disbursal, and great customer support, which made the whole experience stress-free.

To be honest, Shenzhen’s crypto firms feel like they’re light years ahead in innovation.

Be cautious with gas fees when transferring Shitcoin to Bitpie—sometimes they spike unexpectedly!

Swapped to this mining power supply, and now my system’s running cooler, quieter, and faster!

This miner allows me to minimize my carbon footprint and mine from home, it is perfect for me!

To be honest, jumping on Bitcoin crowdfunding prices felt like getting a secret invite to the best VIP crypto party—I got in early, and it paid off a lot quicker than chasing market prices later.

To be honest, Bitcoin has kind of become the ultimate stress test for chip durability and efficiency, accelerating the whole sector’s R&D cycles.

Their mining hosting has been a real game changer, with great profit analysis and solid guidance I am going to be rich, I am sure.

You may not expect this, but the Dutch Bitcoin Mining Tutorial integrates real-world case studies from Dutch miners, covering uptime metrics and cooling systems that enhanced my operational efficiency immensely.

Honestly, this miner downturn is brutal—many were holding on, hoping things would improve, but when BTC dived past $20K, that optimism quickly disappeared, showing just how risky mining really is.

Trading Bitcoin on Huobi feels super legit, with clear audit trails and quick dispute resolution for any glitches—you rarely see this level of trust in crypto exchanges.