Navigating Zcash Miner Price Fluctuations Toward 2025

As the world of cryptocurrencies continues to evolve at a breakneck pace, the demand for mining machines has surged. Many investors and enthusiasts are setting their sights on Zcash, a privacy-centric cryptocurrency that has gained traction alongside mainstream coins like Bitcoin and Ethereum. With fluctuating prices for Zcash miners, understanding these price movements becomes critical for anyone currently mining or considering hosting their mining rigs. The landscape is undeniably dynamic, but how can one navigate these waters effectively?

Firstly, it’s essential to grasp the fundamentals of Zcash mining. Much like Bitcoin, Zcash uses a proof-of-work consensus mechanism, which requires miners to solve complex mathematical problems. This process validates transactions and creates new coins. However, unlike Bitcoin, which is often seen as digital gold, Zcash aims to provide unparalleled privacy to its users. This unique selling point has influenced both its value and the interest in mining hardware designed specifically for Zcash.

The cost and performance of mining machines can be volatile. The main factors driving the price fluctuations of Zcash miners include advancements in technology, energy consumption, and market demand. As newer, more efficient models enter the marketplace—often boasting improved hash rates—the older models tend to depreciate in value, creating an environment fraught with uncertainty for prospective miners. To ensure profitability, it is crucial to stay informed about technological innovations and to invest wisely in hardware that promises a balance between cost and performance.

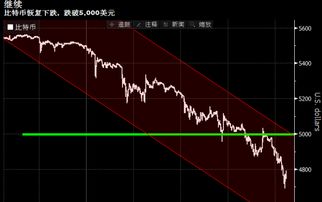

Another layer of complexity arises from cryptocurrency market cycles, particularly with leading coins such as Bitcoin and Ethereum often acting as bellwethers for other cryptocurrencies. The performance of these larger currencies can ripple through the market, impacting Zcash and the overall demand for mining rigs. A bullish Bitcoin market often leads to an influx of capital into altcoins, including Zcash, potentially driving up miner prices. Understanding the correlations between these currencies can provide crucial insights into when to buy and when to sell.

In addition to price fluctuations driven by the above factors, global economic conditions also play a significant role. Regulatory developments, changes in energy prices, and macroeconomic trends can impact profitability. For instance, countries with cheaper electricity may attract more miners, driving competition and affecting miner prices. Keeping an eye on these external variables is paramount for anyone involved in mining or considering mining farm hosting. Tailoring strategies to your local context and market dynamics can significantly improve your chances of success.

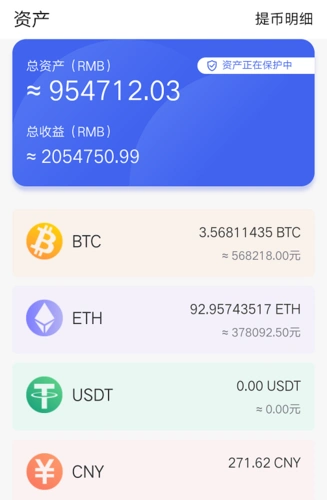

The hosting of mining machines presents another avenue worth exploring when considering Zcash mining profitability. Rather than setting up a rig at home, many are turning to professional hosting services that provide better cooling, maintenance, and, crucially, cheaper electricity rates. By leveraging these services, miners can maximize their return on investment. The state of the hosting industry is another fluctuating element; demand for hosting can spike in tandem with market interest in cryptocurrencies, further influencing miner prices.

Ultimately, the path to navigating Zcash miner price fluctuations toward 2025 is multidimensional. From understanding the intricacies of mining technology and market behavior to analyzing broader economic trends, a comprehensive approach is essential. The interplay between innovations in miner technology, the performances of major cryptocurrencies, and external economic factors necessitates a keen eye and adaptable strategies.

For those keen on jumping into or expanding their Zcash mining endeavors, remaining agile and informed is crucial. Some may focus on acquiring the latest mining rigs, while others may take a more reserved approach, opting to host their machines in optimized environments. As the market matures, those equipped with the knowledge and strategy to adapt to ongoing changes will likely emerge as the new leaders in the mining landscape.