Expert Insights on ASIC Miner Prices and Reliable Hosting Options Available

In the ever-evolving landscape of cryptocurrency, ASIC miners have emerged as indispensable tools for enthusiasts and professionals alike, driving the backbone of blockchain validation across networks. Their specialized design, optimized specifically for mining digital currencies such as Bitcoin, renders them significantly more efficient than general-purpose computing devices. However, the conversation inevitably turns to pricing and hosting options, elements that fundamentally influence an investor’s profitability and operational sustainability. Understanding the nuances behind ASIC miner prices and discerning reliable hosting solutions can unlock opportunities that are often misunderstood in this intricate market.

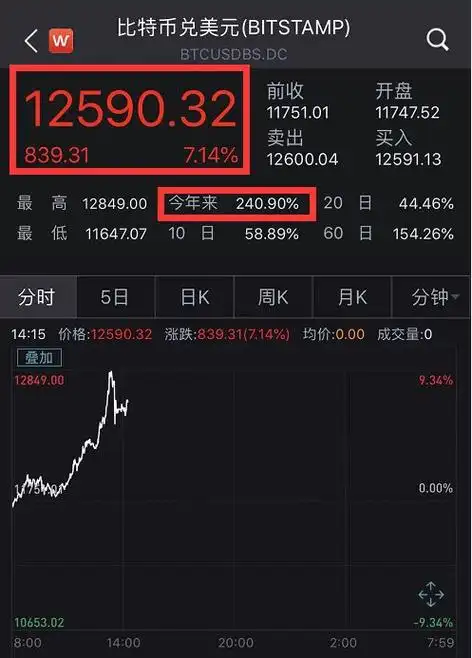

The cost of an ASIC miner is no mere figure; it encapsulates technological sophistication, manufacturing complexity, and market dynamics. Early models, while groundbreaking at their time, have progressively given way to advanced iterations boasting higher hash rates and improved energy efficiency. Bitcoin miners, for instance, have seen the leap from basic Antminers to cutting-edge S19 Pro units, which can perform trillions of hashes per second with optimized energy consumption. But these enhancements come with a price tag that can create financial hurdles. Fluctuating cryptocurrency valuations cause ripple effects in hardware demand, often inflating prices during bullish phases. Moreover, supply chain disruptions and international trade policies inject further unpredictability—turning ASIC miner acquisition into both a calculated risk and strategic investment.

Moreover, the decision to directly purchase and operate mining equipment necessitates an evaluation of infrastructure readiness. Mining rigs are, by their nature, intensive consumers of power and generate significant heat. This scenario underscores the rising appeal of hosting services—specialized data centers that offer mining machine hosting with robust electricity, cooling systems, and maintenance protocols. Such facilities alleviate the burden on individual miners, offering a turnkey solution that mitigates operational risks like downtime or overheating. Pioneering hosting providers often offer flexible contracts to accommodate everything from solo hobbyists to expansive mining farms, integrating intelligent monitoring tools that enable real-time performance tracking and remote troubleshooting.

Delving deeper, hosting options not only serve logistical purposes but influence the economics of mining itself. With Bitcoin’s finite block reward halving events—where mining rewards are periodically reduced—efficient operation becomes paramount. Miners who outsource to hosting providers can capitalize on reduced overheads, such as negotiated bulk energy rates or economies of scale in hardware maintenance. Additionally, hosting farms sometimes diversify their cryptocurrency portfolio by supporting various algorithms, accommodating miners of Ethereum, Dogecoin, or newer altcoins. This multifaceted approach helps spread risk, stabilize income streams, and exploit the strengths of different mining hardware options, including dual-purpose rigs able to pivot based on network difficulty and coin profitability.

On the exchange front, the interplay between hardware investment and currency liquidity is critical. ASIC miners dedicated to Bitcoin and asics optimized for coins like Litecoin or Dogecoin must contend with volatility not only in token prices but also in mining difficulty and block propagation rates. As miners secure freshly minted coins, seamless integration with exchanges determines their ability to convert digital wealth into fiat currency or re-invest. Platforms vary widely in fees, security protocols, and withdrawal speeds, making the selection process as vital as choosing the right mining machinery or hosting provider. Mining itself is only one leg of the journey; the exit strategies and trading functionalities complete the cycle of profitability and growth.

The cryptocurrency ecosystem continues to evolve at a breathtaking pace. Ethereum’s ambitious transition toward proof-of-stake mechanisms reshapes its mining landscape, prompting miners reliant on GPU rigs to reconsider their positioning. Meanwhile, Bitcoin mining remains an ASIC-dominated field, where rig performance and hosting reliability coalesce to influence success. Entrepreneurs embarking on mining ventures must navigate a labyrinth of variables: from hardware selection and pricing to selecting data centers with verifiable uptime and transparent energy sources, to choosing exchanges that harmonize with their financial objectives. The synergy between these elements cultivates a competitive edge in a market where milliseconds and megahashes differentiate fortune from failure.

For companies specializing in the sales and hosting of mining machines, this knowledge is a powerful asset. Providing customers not only with the latest hardware but also expert guidance on the optimal hosting options creates an ecosystem that fosters sustained profitability. As regulations tighten and energy concerns mount globally, hosted mining solutions with renewable power integrations and smart cooling innovations gain prominence. The future of cryptocurrency mining hinges on adaptability—embracing technological advancements, smart financial strategies, and operational efficiencies. In this arena, knowledge truly powers success, and expert insights transform complex investments into rewarding ventures.