Unveiling the Best Low-Noise ASIC Mining Machines for Efficient Cryptocurrency Mining

In the ever-evolving world of cryptocurrency, where digital gold rushes unfold in the blink of an eye, the quest for efficient mining solutions has become paramount. Enter the realm of ASIC mining machines—specialized hardware designed to crunch complex algorithms with unparalleled speed and precision. But what if we told you that silence could be your secret weapon? Low-noise ASIC miners not only whisper through their operations but also pave the way for sustainable, efficient cryptocurrency mining that minimizes disruptions in homes, offices, or dedicated setups. As we unveil the best options on the market, imagine transforming your mining endeavors into a seamless symphony rather than a cacophonous ordeal.

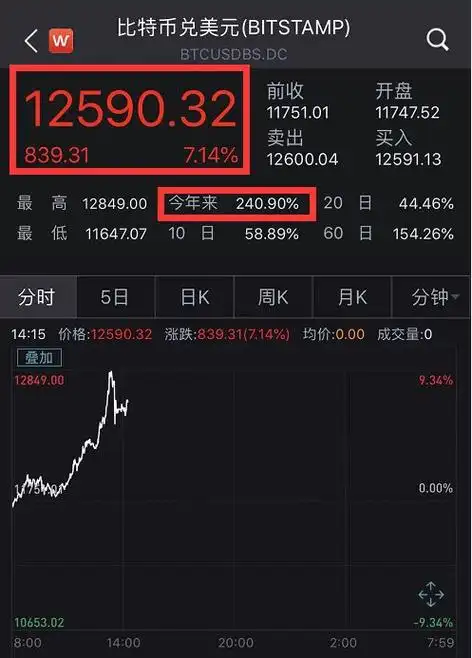

Bitcoin, the pioneer of cryptocurrencies, demands robust mining rigs that can handle its proof-of-work consensus mechanism without breaking a sweat. These low-noise ASIC machines, tailored for BTC, operate at whisper-quiet decibel levels, making them ideal for urban miners who can’t afford the headache of constant noise pollution. Unlike generic hardware, ASICs are optimized solely for specific algorithms like SHA-256, which BTC employs, ensuring that every watt of energy translates into maximum hash rates. Picture this: a sleek device humming softly in your living room, quietly amassing fractions of Bitcoin while you binge-watch your favorite series. The efficiency gains are staggering—reduced heat output means less cooling costs, and with energy prices soaring, these machines could be the key to profitable mining in 2024 and beyond.

Yet, the cryptocurrency landscape extends far beyond Bitcoin, embracing alternatives like Ethereum and Dogecoin that each require their own mining nuances. Ethereum, for instance, has transitioned to a proof-of-stake model, but many miners still rely on ASIC-compatible setups for other chains or pre-merge ETH extraction. Low-noise models adapt beautifully here, offering versatility for ETH enthusiasts who might pivot between networks. Dogecoin, with its lighter Scrypt algorithm, allows even entry-level miners to join the fun without overwhelming noise, fostering a more inclusive community. By integrating these machines into a diversified portfolio, users can hedge against market volatility, mining multiple currencies from a single, efficient rig. It’s this adaptability that makes low-noise ASICs not just tools, but strategic assets in the volatile crypto wars.

Delving deeper, the concept of mining rigs—assemblies of hardware components working in harmony—takes center stage when efficiency is the goal. A top-tier low-noise ASIC rig might include multiple miners linked via ethernet, creating a fortress of computation that tackles blockchain puzzles with ease. These rigs, often customized for specific needs, stand in contrast to bulky, outdated systems that guzzle power and generate ear-splitting fans. Imagine assembling your own setup: selecting quiet ASIC units, pairing them with efficient power supplies, and monitoring via intuitive software. The burst of innovation in this space is palpable, with manufacturers pushing boundaries to deliver rigs that are as environmentally friendly as they are powerful, aligning with global pushes for greener crypto practices.

Hosting mining machines has emerged as a game-changer, especially for those without the space or expertise to manage rigs at home. Companies specializing in mining machine hosting provide state-of-the-art facilities—think vast mining farms buzzing with activity—where your ASICs can operate under optimal conditions. These farms, equipped with industrial cooling and redundant power, ensure that low-noise machines perform at peak efficiency without the homeowner hassles. For Bitcoin and Ethereum miners, outsourcing to such setups means tapping into economies of scale, where shared resources lower costs and enhance profitability. It’s a symbiotic relationship: you supply the hardware, they handle the logistics, and together, you conquer the crypto frontier.

Now, let’s not overlook the miners themselves—the dedicated individuals and operations that keep the blockchain alive. Whether you’re a solo miner chasing Dogecoin rewards or part of a larger syndicate targeting ETH, low-noise ASICs empower you to work smarter, not harder. These devices reduce the physical strain of mining, allowing for longer operational hours without the drone of machinery disrupting your day. In mining farms, where rows of rigs stand like soldiers, the quiet efficiency of these ASICs fosters a more productive environment, minimizing worker fatigue and maximizing output. The ripple effect is profound: more efficient mining leads to a healthier network, supporting the integrity of currencies like BTC and beyond.

As we wrap up this exploration, it’s clear that the best low-noise ASIC mining machines are more than just hardware; they’re the future of cryptocurrency mining. They blend cutting-edge technology with user-friendly designs, making them accessible for newcomers and veterans alike. From the halls of Bitcoin’s dominance to the playful realms of Dogecoin, these machines ensure that efficiency and silence go hand in hand. If you’re venturing into mining or upgrading your setup, consider the hosting options available—partnering with experts can amplify your success. In a world where every hash counts, choosing the right tools isn’t just smart; it’s revolutionary.